You’ve probably heard this a thousand times, but it is worth repeating: Crypto’s biggest problem is still scalability. It doesn’t matter if we can create cool pictures to sell online, build community owned exchanges, or even run an entire metaverse if people can’t use it.

To date, every major cryptocurrency project is still running into the scalability challenge at some point or another, and we still haven’t found a silver bullet.

However, that doesn’t mean that there is no hope. Layer-2 solutions offer a way to outsource some of the computing power off-chain and reduce general network load. They may become key to solving the scalability challenges of Ethereum in the near future.

Why Does Crypto Still Have Scalability Problems?

Ethereum and all other pure cryptocurrencies use some form of blockchain (or distributed ledger) technology. The blockchain records transactions in a block-by-block format, with each block able to contain a finite number of transactions.

This works well when the number of waiting transactions can fit onto the block in question. However, if you have too many transactions waiting to go onto a block, then some will have to wait. This is not normally a huge problem, but if transaction volume reaches a critical mass, it can create a situation where transaction wait times go from minutes to hours.

This, in itself, isn’t a problem if you’re sending money to friends or family, but it becomes problematic for more urgent transactions. Traders might find themselves taking a loss because the system took too long, shops wouldn’t be able to process payments, and anything that was even remotely time sensitive would become impossible.

This means that cryptocurrencies need systems to prioritize transactions. These systems usually involve some kind of transaction fee and a “tip” (gratuity) for payment processors. The theory is that high transaction fees will discourage network usage at peak times and people who really need a transaction processed quickly can simply pay for it.

The difficulty is that these solutions haven’t solved the scalability problem. Ethereum has experienced highs of hundreds of dollars per transaction in the past year and fees above $3.00 are the norm. These high fees make it difficult to justify using Ethereum for small transactions and represents a very real risk to the long term viability of Ethereum as a backbone of the blockchain ecosystem.

In fact, Ethereum’s network effects stopped growing when gas sustained 300+ gwei during DeFi summer in 2020. This is the moment when Ethereum became a whale chain, and new users were pushed to other chains.

This isn’t some technical problem that only crypto enthusiasts discuss. If scalability isn’t solved, cryptocurrency will never achieve mainstream appeal and will likely eventually become the preserve of a small group of enthusiasts instead of the game changing technology it could be.

What Solutions Are There?

The biggest resource hogs on any blockchain network are decentralized apps (dApps) that require a large number of transactions. The most common example of these kinds of dApps are decentralized exchanges (DEXs), which often need to operate complicated smart contracts to process even just one transaction. This type of processing can incur significant costs for the user, even if the transaction eventually fails because it takes too long.

If it were possible to move some of these transactions off the blockchain to process them while still recording the final outcome on the blockchain, then this could solve a whole host of scalability problems.

In fact, this is one of two ways that new technologies are tackling the scalability challenge. Ethereum 2.0’s new implementation is designed to do exactly this by improving the way that the blockchain itself processes data. It does this using two methods:

The first is to switch away from energy-intensive proof of work (PoW) towards proof of stake (PoS), which is less computationally intensive and therefore cheaper.

The second is to embrace sharding. Multiple smaller blockchains are able to operate in parallel, spreading the load and reducing the potential for a major bottleneck.

These methods represent a solid foundation and could help alleviate some of the scalability problems, but they might not be enough on their own. If usage continues to grow, then these solutions may need to continue to grow, which is why we need to look at the second half of the puzzle: demand.

That is exactly what layer-2 solutions propose to do.

How Do Layer-2 Solutions Work?

We’re about to get a little technical here, so bear with us. Layer-2 solutions cover a broad range of technologies that aim to achieve the same goal: alleviate stress on the layer-1 blockchain (the Ethereum chain itself) by offloading transactions and processing them off-chain.

Once this process is completed, these transactions are then bundled into a single transaction and recorded onto the blockchain.

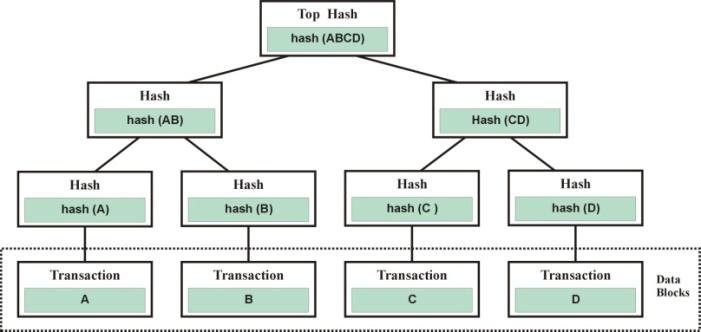

Layer-2 solutions typically take advantage of Merkle trees. These data structures make it easier to process large volumes of data on a blockchain.

The top hash groups a number of transactions together as data blocks, which are themselves grouped under other hashes. Grouping makes it possible to verify a large number of transactions simultaneously by querying the top data block. You don’t need to process every transaction in the Merkle tree to confirm that a single transaction is correct.

All blockchain technologies already use Merkle trees in some form. A layer-2 solution takes it a step further by storing the root (or top hash) of the tree within a smart contract. It then processes the rest of this tree off-chain, instead of on the blockchain itself.

The biggest challenge that any layer-2 solution needs to overcome, that of protecting itself from tampering, is typically solved using non-interactive zero-knowledge proofs (zk-SNARKs). This allows a smart contract to confirm that all transactions are correct and process the single confirmation on the blockchain, reducing 20 transactions into just one.

Layer-2 solutions that use this approach are called zero-knowledge rollups, or zk-rollups. They solve most of the traditional faults of other layer-2 solutions, like long wait times due to potential fraud challenges, by ensuring that nobody needs to personally approve each transaction by using specialized smart contracts.

Zero-knowledge rollups remove the need to trust a third-party organization with blockchain data. The gold standard of these solutions take advantage of decentralized autonomous organizations (DAOs) to ensure that the community has a say in how they grow and are governed rather than a centralized entity.

Polygon Allows Developers to Launch Interoperable Blockchains

There are a few zero-knowledge rollups out there, with one of the most well-known ones being Polygon.

Polygon is the 14th-largest coin by market cap, and it’s probably one of the best known layer-2 solutions. It is interesting because it empowers developers to launch interoperable blockchains rather than just building directly into the Ethereum blockchain itself.

Polygon is built up from four layers: Ethereum layer, security layer, Polygon networks layer, and execution layer. Each of these layers performs a specific function that allows Polygon-developed blockchains to operate.

Polygon basically works as a tool that enables developers to more easily create and maintain specialized blockchains while still using Ethereum as the basic infrastructure. This helps to maintain decentralization and makes it easier for new businesses to implement blockchain tech.

Many Solutions Will Be Needed

Solving crypto’s scalability woes will not be an easy task. It will require a variety of development teams to work together to solve both efficiency and demand problems simultaneously. While the efforts of the Ethereum development team to improve layer-1 are integral to the process, layer-2 solutions will be just as important in the long term.

Fortunately, the amount of innovation in the sector points towards a bright future for cryptocurrency. We are likely to see a proliferation of highly specialized layer-2 solutions that will address the specific challenges of new types of dApps as the ecosystem continues to evolve.

In the meantime, we will have to choose our transactions carefully and try to trade during quiet hours.